It's not how much you make, it's how much you get to keep.

Financial Solutions

Credit Restoration/Credit Repair

Innovated state of the art lawful strategies to comprehensively correct or even delete derogatory inquires and trade lines on your personal credit report with Experian, Equifax, and Transunion. This program can increase your credit score dramatically, to achieve the material things you want in life. Typically, we can find seriously overlooked accounts that may have been charged-off turns out that a judgment has been filed. This can cause a great financial hardship if the judgment is enforced. Most cases, the Judgment Creditor will hold off on enforcing the judgment for a few years to make you feel comfortable that nothing will come of it. Then unexpectedly your bank account is levied or a wage garnishment is filed with your employer. If a charged-off debt is properly filed into a judgment, this is basically called a legalized debt that can be enforced with interest.

Credit Builder

A good credit history is vital to your financial health. But how can you build one if you have experienced poor payment history or have no credit history at all? Our Credit Builder program may help you improve your credit score in as little as 12 months.*

Credit-builder loans can help you build your credit score, and they don't require good credit to start with. They're not widely advertised and we have partnered with financial institutions, such as credit unions and community banks to help people achieve credit respectability. Financial institutions would like to see you succeed.

*Results not guaranteed. Improvement in credit score dependent on your specific situation and financial behavior.

Credit & Debt Management

Your guide to understanding credit and debt.

If you’re feeling as if you need some additional support to help manage your debt and organize your finances, Simple Strategic workshops or one-on-one courses could be a good option for you.

One of the biggest misconceptions about credit analysis programs is that you must be in dire straits to benefit from it. That’s simply not true. Credit analysis can be a good resource for those who would like assistance with their credit and financial plans.

However, it’s important to note that a credit analysis program isn’t necessarily the same thing as credit counseling — and it’s not the right fit for everyone.

-

Advise on managing money and debts

-

Educational materials and workshops

-

Organize a “money management plan” to pay down your debts

-

Customize plan to improve your financial situation

-

Referrals to other tools and resources to help you gain control over your money

-

Understanding credit and debt, student loan debt, housing and mortgage loans.

*This is NOT a Debt management plan (DMP), which can help you get out of debt faster, typically by lowering your interest rates and setting up a payment schedule. DMP allows “credit counseling agency” to make payments on some or all of their accounts.

Family Premium Banking

If you use a participating whole life insurance policy for a Family Premium Banking, your cash value increases every time the insurance company pays dividends. It also increases when you pay policy premiums and earns a guaranteed interest rate.

Essentially your “bank” consists of a portion of premiums paid (money from you) + guaranteed interest earned + potential dividends (money from your insurance company).

Instead of storing your savings in a traditional bank account with minimal returns, you save inside of your dividend-paying whole life insurance policy, where it grows tax-free with a higher rate of return. It also increases when you pay policy premiums and earns a guaranteed interest.

Income Protection

Customize Income Protection, Income Replacement, & Tax-Free Retirement

Specializing in Income replacement policies with Living Benefits, Protection in the event of a Chronic, Critical, and even Terminal Illness. Protect yourself and your loved ones on the WHAT IF's in Life. WHAT IF I Die to Soon, WHAT IF I get Sick, WHAT IF I Live to Long.

Estate Planning/Living Trust

For every $100,000 in estate assets, you could spend as much as $10,000 on probate costs for appraisals, attorneys, court fees, and more.

Probate court is time consuming, stressful, and completely open to the public! Without a plan, you are jeopardizing your family’s privacy and exposing your family to unnecessary risks.

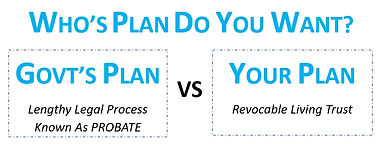

If you don’t have a plan,

The government does…

and it will cost you.

If you don't have a plan in place, the government has a "one-size-fits-all" plan they will impose for you. This plan is slow, expensive, and completely public.

Don't let this happen to you and your family. Get a plan in place to protect your family, your assets, and your peace of mind.